The COVID19pandemic accelerated the adoption of new technologies worldwide, pushing digitalization faster than ever before during that period. When combined with the current bear market, this created an especially complex landscape that left investors and startups struggling to close deals. With establishing true value becoming an increasingly difficult process, many are wondering where is and where is going the pre-IPO deal flow?

With investors currently looking for the best way to deal with the inconsistencies of the current economic landscape, caution seems to be the law of the land across markets. As such, investors are choosing to focus on projects generating actual value instead of their potential, status, or connections. This means that at this time, a startup with a positive balance sheet has a unique opportunity to beat unicorns when it comes to raising pre-IPO funding.

Surprisingly, Venture Capitalists in the crypto ecosystem seem to have remained more cool-headed than their stock counterparts. It is well known by now that Andreessen Horowitz raised a $4.5 billion crypto fund. However, other Crypto investors have also achieved the same, with Sequoia raising $500 million back in May and Binance lab doing the same in early June.

What all of these funds have in common is their heavy focus on Web3 projects, a continuation of a trend that has been going on for several months. The popularity of Web3 in the tech world has been so overwhelming that tech giants like Google, Facebook, and Amazon have been unable to deal with it. Despite having been the mecca for tech employees for more than a decade, these companies have seen an exodus of top talent looking to work in Web3.

While Web3 is only one of the niches driving the pre-IPO deal flow in the blockchain space, its relevance is of special significance. This is especially true due to the criticism Web3 has received from figures like Jack Dorsey, Aaron Levie, Stephen Diehl, and Molly White. Despite this criticism, investors like Marc Andreessen are extremely bullish on Web 3, going as far as saying:

“The easiest way to think about it is: When you get something like this, this sort of collective effect that has a movement behind it and is attracting many of the world’s smartest people to work on it… basically the criticisms end up playing out differently than the critics think. These critics make a long list of all the problems but these genius engineers and entrepreneurs look at that list of problems as a list of opportunities.”

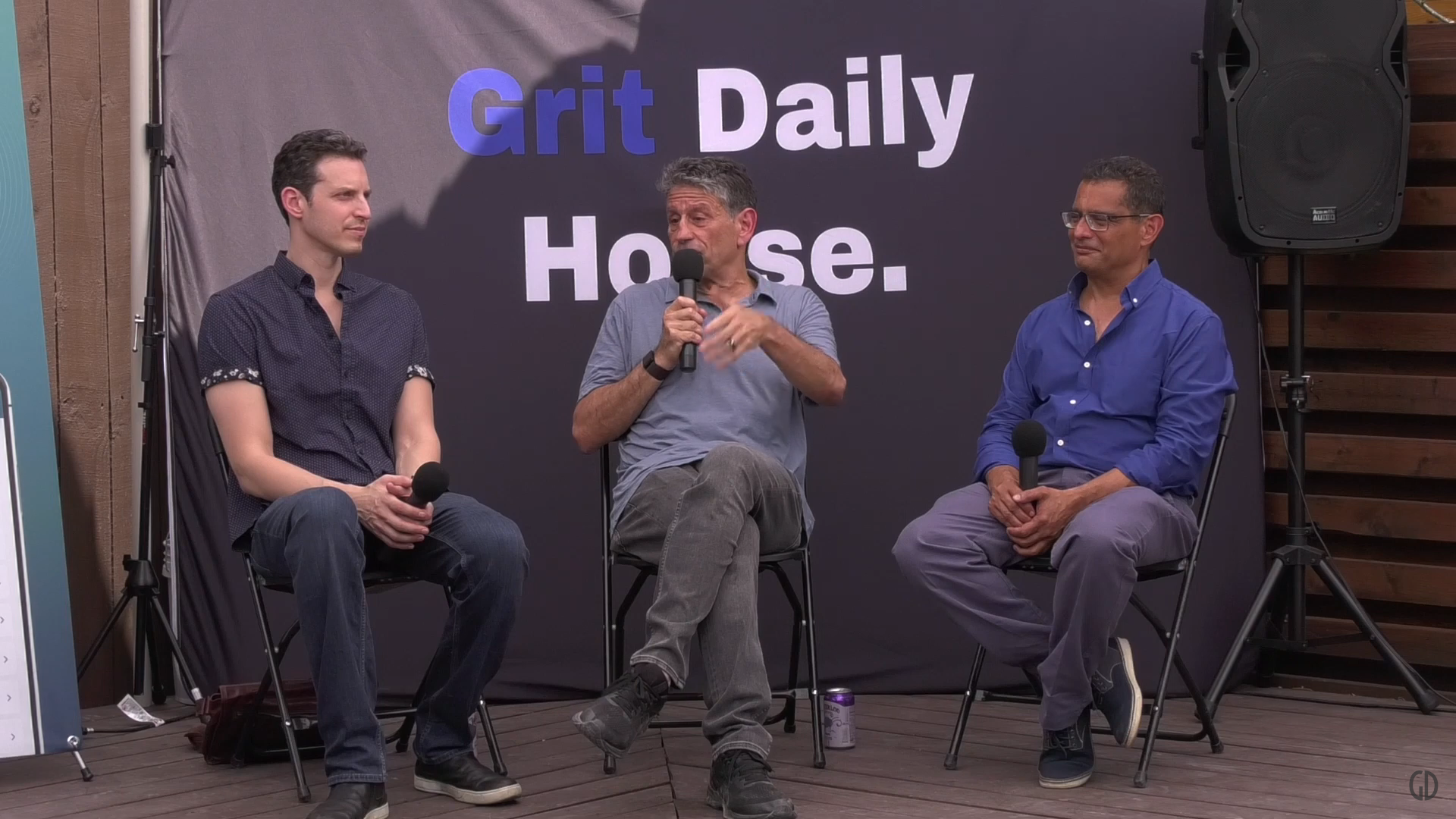

The question “Where Is the Pre-IPO Deal Flow?” was the main topic of one of the panels at Grit Daily House earlier this month. Karim Nurani, Chief Strategy Officer at Linqto; Evan Greenberg Co-Founder of Blockchain Beach; and Marc Weill, Senior Advisor at Two Sigma Ventures, sat to share the unique environment that has emerged with the latest market winter.

If you missed the chance to attend Grit Daily House in person and to hear what these panelists have to say about this topic, worry not. You will be able to watch the panel in the video below and find our other panels on Grit Daily’s official YouTube Channel.