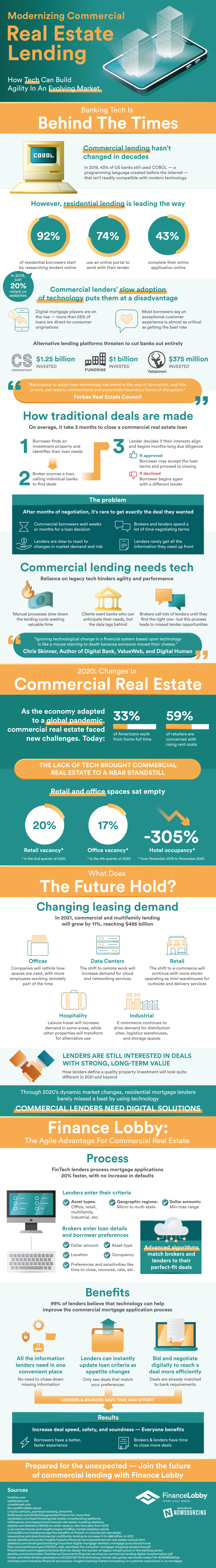

The capacity of new technology to bring ever greater agility into an evolving market is well documented. Yet so far, not every evolving market has adapted to the times. Commercial real estate lending is still using the same processes it has used for decades. Closing a traditional deal takes 3 months , with much of the time spent on calls between a broker and individual banks. As recently as 2019, over 40% of US banks still relied on COBOL, a programming language older than the internet, to carry out vital tasks.

The commercial real estate lending process today is incompatible with trends in commercial real estate finance attracted by a market expected to grow 11% to $486 billion this year. Commercial real estate faced new challenges as the economy adapted to a global pandemic. Today, 33% of Americans work from home full time, with even more who are remote on a part-time basis. Companies are rethinking how they use office space with fewer workers consistently around. Meanwhile, 59% of retailers are concerned with rising rent costs. The shift to ecommerce will continue with more stores operating as mini-warehouses for curbside and delivery services. In a similar vein, ecommerce is driving up demand for distribution sites, logistics warehouses, and storage spaces.

Commercial Real Estate Lending Needs to Catch Up

Cutting edge platforms like Crowdstreet and Fundrise already have over $1 billion invested. Not only is this fate scary to banks, but it’s also 100% avoidable. “Ignoring technological change in a financial system based upon technology is like a mouse starving to death because someone moved their cheese,” says Digital Bank author Chris Skinner. With new tech startups, commercial real estate can receive an agile advantage. Fintech lenders process mortgage applications 20% faster, with no increase in defaults. The steps are simple: lenders and brokers enter their criteria, loan details, and borrower preferences into the same system. Once each side has entered their information, advanced algorithms match brokers and lenders to their deals of best fit.

The Benefits of Digital Sorting are Enormous

All the information lenders need rests in one convenient place. Landers can instantly update loan criteria as their appetite changes, and they only see deals that match their preferences. Bidding and negotiating stages are streamlined due to deals already matching bank requirements. In short, both lenders and brokers save time and effort. Borrowers have a better, faster experience while brokers and lenders have time to close more deals.