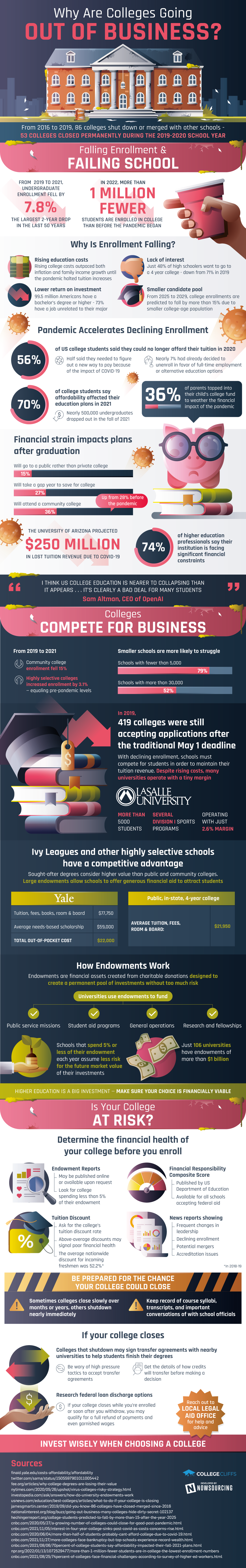

From 2016 to 2019, 86 colleges shut down or merged with other schools. 53 colleges closed permanently during the 2019-2020 school year. Why exactly are colleges going out of business?

One of the major factors is the drop in enrollment. From 2019 to 2021, undergraduate enrollment fell by almost 8%. This is the largest 2-year drop in the last 50 years. In 2022 alone, more than 1 million fewer students are enrolled in college than before the pandemic began.

What is Causing the Drop in Enrollment?

Rising education costs have outpaced both inflation and family income growth until the pandemic halted tuition increases. Also, only 73% of 99.5 million Americans who have a bachelor’s degree or higher have a job unrelated to their major.

A smaller candidate pool is also a contributing factor. College enrollments are actually predicted to fall by more than 15%. This is planned between 2025 and 2029 due to the smaller college-age population. Another big reason is the lack of interest in college. Just 48% of high schoolers want to go to a 4-year college. This is a big difference from 71% in 2019.

Colleges are Becoming Unaffordable

The pandemic had an impact on declining enrollment. 56% of U.S. college students in 2020 stated that they could no longer afford their tuition. Half of these students needed to figure out a new way to pay due the pandemic. About 7% had already decided to unenroll in favor of full-time employment or alternative education options.

In the fall of 2021, 70% of college students say affordability was a factor in their plans. Nearly 500,000 undergraduates dropped out in the fall of 2021. Financial strain has also impacted plans after graduation. 36% of parents tapped into their child’s college fund to weather the financial impact of the pandemic. High schoolers are now more likely to choose a less expensive option. These include going to community or public colleges or taking a gap year to save for college.

74% of higher education professionals have said their institution is facing significant financial constraints. For example, the University of Arizona projected $250 million in lost tuition revenue due to COVID-19. There is added pressure when you consider colleges as entities competing against each other for business.

How are Community Colleges Faring?

From 2019 to 2021, community college enrollment fell 15%. Meanwhile, enrollment at highly selective colleges increased by 3.1%, which equaled pre-pandemic levels. Smaller schools are also more likely to struggle due to fewer open spots for enrollment compared to bigger schools. In 2019, 419 colleges were still accepting applications after the traditional May 1st deadline.

With declining enrollment, schools will have to compete for students in order to maintain their tuition revenue. However, even with rising costs, many universities operate with a tiny margin. For example, La Salle University has more than 5,000 students but operates with just a 2.6% margin.

Not all colleges are going out of business. Ivy Leagues and other highly selective schools have a competitive advantage compared to other schools. Sought-after degrees are considered higher in value at selective schools compared to public and community colleges. Large endowments also allow Ivy Leagues and similar schools to offer generous financial aid to attract students.

Endowments: How Schools Will Survive

Considering that endowments are beneficial in helping schools survive, how do they really work? Endowments are financial assets created from charitable donations. They are designed to create a permanent pool of investments without too much risk. Universities use endowments to fund general operations, student aid programs, research and fellowships, and public service missions. Schools that typically spend 5% or less of their endowment each year assume less risk for the future. Only 106 universities have endowments of more than $1 billion.

Higher education is a huge investment, so it’s important you make sure your choice is financially viable. You can do this by determining the financial health of your selected college before you enroll. Looking over endowment reports, tuition discounts, the financial responsibility composite score, and news reports can be great sources of information.

In Conclusion

You should also be prepared for the chance your college could close. Some colleges close slowly over months or years while others shut down nearly immediately. If your college does close, they might sign transfer agreements with nearby universities to help students finish their degrees. Be wary of high pressure tactics to accept transfer agreements and get the details of how credits will be transferred before making a decision.

It might also be helpful to reach out to local legal aid offices for help and advice if you know your college will close. Researching federal loan discharge options can also be beneficial, especially when your college closes while you’re enrolled or soon after you withdraw because you may qualify for a full refund of payments and even garnished wages.

With the economic state we’re in, be sure to invest wisely when choosing a college. Learn more about colleges going out of business in the infographic below: